The OBBBA Webinar Launch Kit

Ready-to-Use Sales and Marketing Webinar to Add Tax Advisory Services

Complete webinar system, just add your contact information and launch this week.

The Reality:

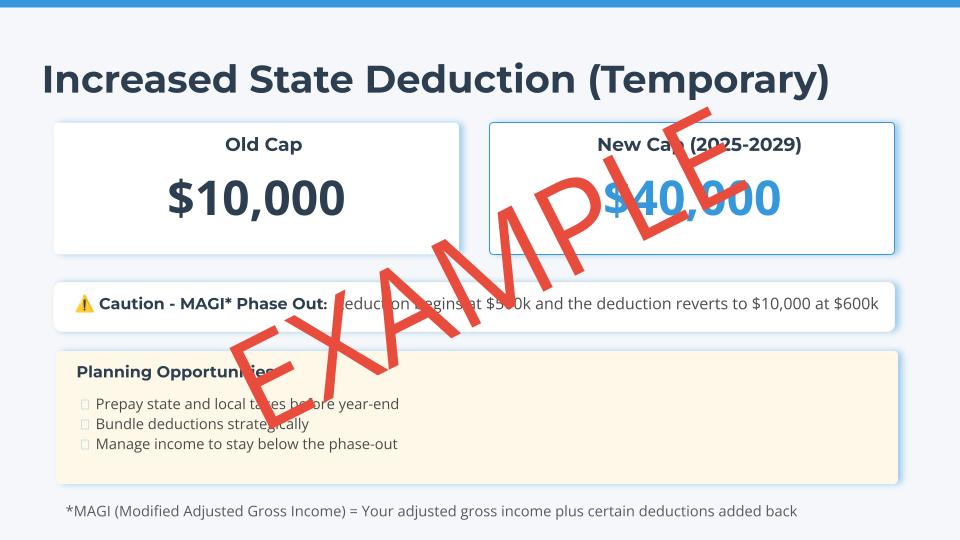

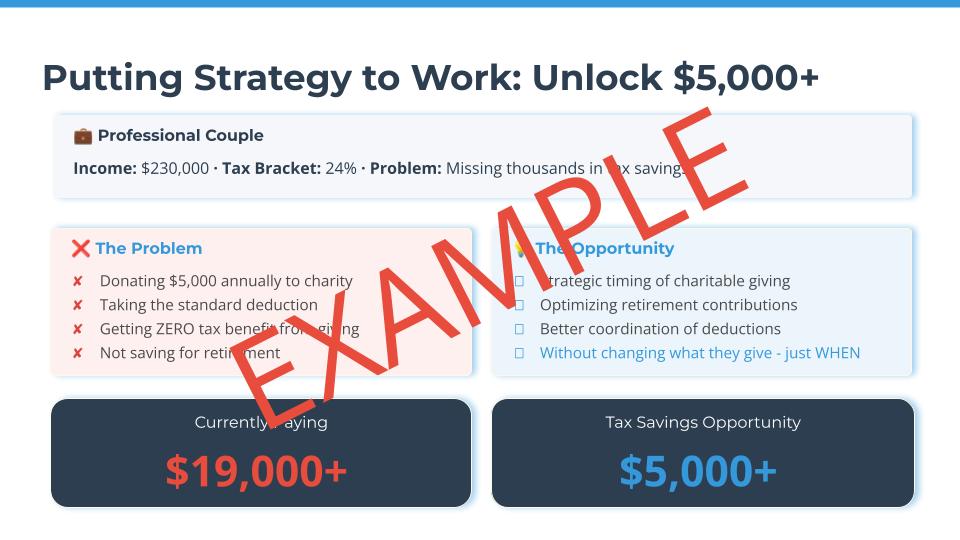

OBBBA just created planning opportunities worth $5,000 to $50,000+ in tax savings per client

Here's the problem:

Your clients don't know about them. And you don't have time to explain complex tax strategies to 200 clients one-by-one.

Even if you tried, most clients don't understand the difference between "filing taxes" and "tax planning", so they won't see why they should pay you for advisory work.

The Result?

You're leaving advisory revenue on the table while the top-performing tax professionals are already using webinars to present OBBBA opportunities at scale, position themselves as strategists, and convert clients into $3,500+ advisory engagements.

Here's How to Fix it:

You need a way to present OBBBA opportunities to all your clients at once, position yourself as a strategic advisor, and create natural openings for advisory conversations, without spending weeks building it yourself.

That's exactly what this system does.

INTRODUCING

The OBBBA Webinar Kit

What You're Getting:

The complete done-for-you webinar system, from the first invitation email to the final consultation booking. No guesswork, no starting from scratch.

Professional 26-Slide Presentation

Clean, modern design (add your name and contact info)

Covers key individual and business OBBBA changes

Two detailed case studies examples

40-minute version (+ expandable 60-minute option with Q&A)

Video walkthrough: Slide customization guide

Complete Speaker Notes

Slide-by-slide talking points

Timing guidance for each section

Transition scripts between topics

Tips on planning opportunities for the new OBBBA changes

Invitation and Follow-up Email Templates

Referral partner invitation template

Client & prospect invitation template

Post-webinar follow-up email templates

Video walkthrough: Email customization guide

Implementation Resources

Quick start checklist

Tech setup checklist for your webinar platform

Post-webinar action guide

Video walkthrough: Case study presentation guide

BONUS: Live Workshop Session

Build out your customized webinar with guidance

Ask questions and get real-time support

Troubleshoot any setup challenges

Connect with other tax professionals implementing the system

BONUS: Pop-Up Community for Additional Support

Get additional help after the live workshop session is over.

Share strategies and wins with fellow tax professionals

Access exclusive tips and best practices during launch period

BONUS: Masterclass: Simple Ways to Charge for Advisory Services

Identify which services you can charge for as tax advisory (not just complex strategies)

Create simple advisory packages for your small business clients

Learn how to price and package advisory services from a practicing tax strategist

🎁CYBER MONDAY BONUS: 30 Day Membership - Tax Pro Society

Monthly live coaching and Q&A sessions with tax practice experts

Private community of tax firm owners building advisory practices

Exclusive training library, tools, and full session replays

Here's What this Solves

Problem

You want to add advisory services but don't know how to market them.

Solution

This webinar does the marketing for you. It presents OBBBA opportunities at scale while positioning you as the advisor who can help.

Problem

Creating a professional webinar from scratch takes 30-40 hours you don't have.

Solution

Everything is done. Add your name and contact info to the slides and you're ready to launch.

Problem

You're not sure what to say, when to say it or how to structure it for a presentation.

Solution

Slide-by-slide speaker notes walk you through the presentation with specific timing.

Investment

Building this yourself would require significant time:

Research and content development: 15-20 hours

Slide design and layout: 8-10 hours

Email sequence writing: 4-6 hours

Testing and refinement: 6-8 hours

Or you could hire it out (marketing consultant + designer = $5,000-$8,000).

Instead, you're getting everything for $547.

Regular Price: $697

$547

🎁CYBER MONDAY BONUS: 30 Day Membership to the Tax Pro Society!

Use Code: CyberMonday2025

(Offer expires December 3, 2025)

What others are saying?

"The content is high quality and technically sound, presented in a thoughtfully packaged format. This is exactly what I was looking for to help me generate additional revenue and better serve my clients.!"

Sarah B.

CPA Firm Owner

"The kit is well thought out and helps you prepare for potential issues like tech problems. It given me confidence to share with both current clients and referral sources, providing real value while emphasizing the importance of proper year-end tax planning amid tax law changes"

Amanda L.

CPA Firm Owner

The December 31st Factor:

Most planning strategies have year-end deadlines:

Equipment must be acquired and placed in service

Retirement plans need to be established

S-corp compensation needs to be finalized

Estimated payments may need adjusting

This creates natural urgency for your clients to engage before year-end, but only if they know about these opportunities.

If you host this webinar in the next few weeks, you can help clients implement strategies before December 31st. If you wait until tax season, they'll have missed the 2025 window.

Who is this For:

CPAs, EAs, and tax professionals who want to add advisory services

Practitioners who are comfortable with tax planning but unsure how to market it

Anyone who wants to educate multiple clients efficiently

Tax pros who want to be seen as strategic advisors, not just preparers

Who This Isn't For:

People looking for done-for-you marketing services

Practitioners who only want to do compliance work

Anyone expecting clients to appear without any effort

Tax professionals who won't actually deliver the webinar

How This Works:

Purchase and download

Instant Digital Access

Add your name, firm name and contact information

Customize the slides

Review the speaker notes

Practice the presentation at least once

Schedule your webinar

7-14 days out

Send invitation emails

Templates provided

Deliver the presentation

40 Minutes

Follow up with attendees

System Provided

Use Code: CyberMonday2025

(Offer Expires December 3, 2025)

Common Questions

"I've never hosted a webinar before. Will I be able to do this?"

The speaker notes walk you through every slide with talking points and timing. Practice it once to get comfortable, and you're ready to go.

"What platform do I need?"

Any webinar platform works, Zoom, Google Meet, Microsoft Teams, etc. The tech guide covers all major platforms.

"How do I get people to attend?"

Email invitation templates are included. We also cover best practices for timing, reminders, and maximizing attendance.

"Do I have to charge for advisory consultations?"

No. Some practitioners offer complimentary consultations, others charge. The framework works either way.

"When do I get access?"

Immediately after purchase. Everything is sent to your email as soon as your purchase is complete.

"What is your refund policy?"

All sales are final. You receive instant access to the complete webinar launch kit upon purchase. The good news: one advisory consultation pays for the entire kit.

Q: "How much tax experience do I need?"

You should have knowledge of business tax fundamentals. This is a webinar to help you market advisory services, not a tax training course.

Q: What if I have more questions?"

We're here to support you! If you'd like more information email [email protected]